can you look up a tax exempt certificate

The IRS defines a tax-exempt organization as an entity that does not need to pay income taxes and does not have to submit a federal income tax returnPrint Tax Exempt Certificate. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office.

Intend to use the property or service for a purpose that is exempt from sales tax.

. Additional Information for new users. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers.

Only organizations exempt under 501 c. An IRS agent will look up an entitys status for you if. Verify a sales tax exemption number E-number.

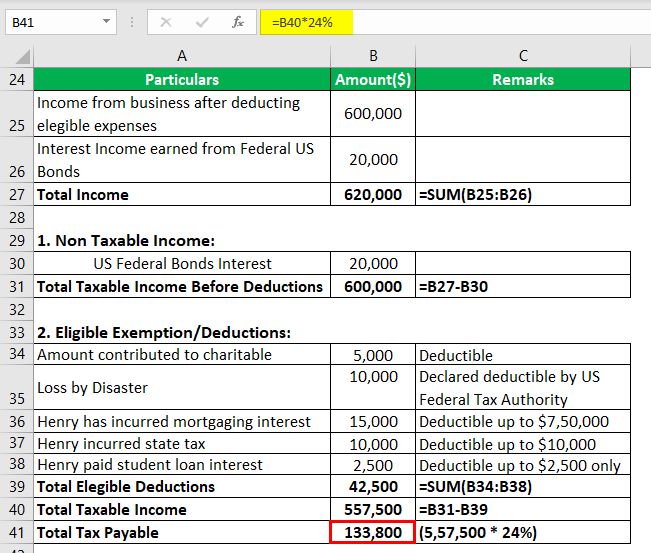

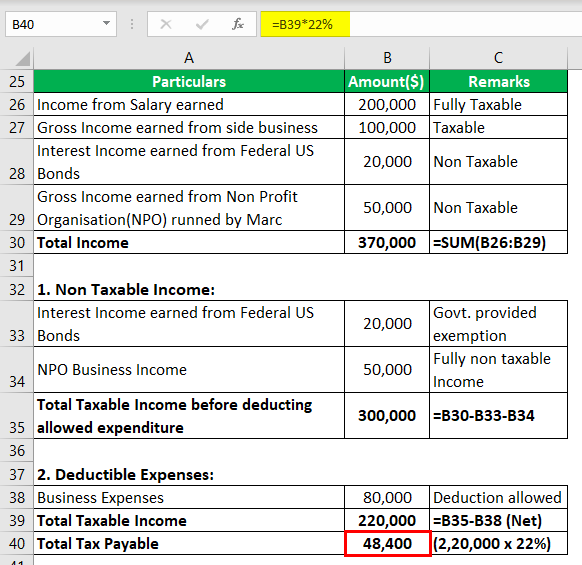

A tax-exempt form is a form that exempts an organization from paying taxes. The form is dated and signed. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number.

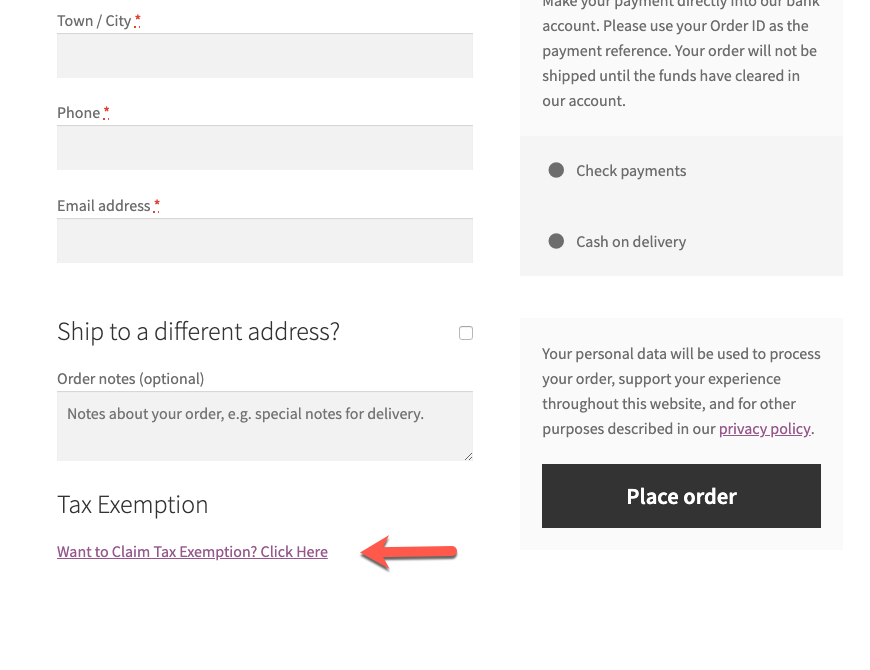

Sales Tax Exemption Certificates for Governmental Entities. You can verify that the organization is a tax exempt non-profit organization. To apply for tax-exempt status the following must happen.

The exemption certificate must be complete An exemption certificate must be thoroughly completed by the purchaser to. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Here are several steps a company should take to validate a certificate.

You can get those details from the tax exemption certificate the buyer will provide you and its details must match their invoice details. Business Incentives Reporting and Building Materials Exemption Certification. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax.

In general a tax-exempt certificate is a document that allows a buyer to conduct tax-free transactions of goods and services that qualify for such a tax break. In turn the tax-exempt certificate is kept by the seller which gives them the go-ahead to transact with the. Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries.

You may also contact the Internal Revenue Service at 877829-5500 and ask that they verify the. Although you cannot search by tax exempt number you can search by the organization and location. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

In most cases it is the responsibility of a buyer to fill out the tax-exempt certificate at the point of purchase. When accepting a resale or tax exemption certificate it is important to ensure that a buyer provides you with a valid document. The identifying information for your business is part of the public record and it is available to anyone who wants to find it.

Florida law grants governmental entities including states counties municipalities and political subdivisions eg school districts or municipal libraries an exemption from Florida sales and use tax. Production Related Tangible Personal Property Is Now Included within the Manufacturing Machinery and Equipment Exemption. Due diligence can require verification of tax registration numbers and confirmation that existing validation processes are setup correctly.

Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses. Choose Search and you will be brought to a list of organizations. This is a mandatory step regardless of whether the entity has employees or not.

13 rows Introduction. The name of the buyer matches your customer name. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

All information on the certificate is completed. Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. Sellers must retain copies of the exemption certificates.

Sales tax exemption certificates enable a purchaser to make tax-free purchases. The purpose of the business must be expressed in full detail. The Department of Revenue recently redesigned the certificates the Department issues.

Sellers should exclude from taxable sales price the transactions for which they have accepted an exemption certificate from a purchaser as described below. Choose the option that enables you to search by the business name or the owners name. Complete the Type of Business Section.

In New York for instance you may use an exemption certificate if as a purchaser you intend to resell the property or service. Or you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities. If a seller accepts an unsigned and undated certificate the liability for the sales tax will likely be on the seller.

A purchaser must give the seller the properly. Find the website for your states department of revenue and click on the option that allows you to look up a business. The organization can be a charitable religious or educational institution.

Use the form below to verify that the customer possesses a valid tax exempt number or. A copy of the articles of incorporation must be submitted. An EIN or Employee Identification Number must be obtained.

Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each. A holistic process one that incorporates transacting party information your companys nexus footprint.

Free 10 Sample Tax Exemption Forms In Pdf

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Woocommerce Tax Exempt Customer Role Exemption Plugin

Sales Tax Exemption For Building Materials Used In State Construction Projects

Tax Exempt Meaning Examples Organizations How It Works

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Free 10 Sample Tax Exemption Forms In Pdf

Costco Tax Exempt Fill Out And Sign Printable Pdf Intended For Best Resale Certificate Request Letter Template Briefvorlagen

Printable California Sales Tax Exemption Certificates

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Free 10 Sample Tax Exemption Forms In Pdf

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status